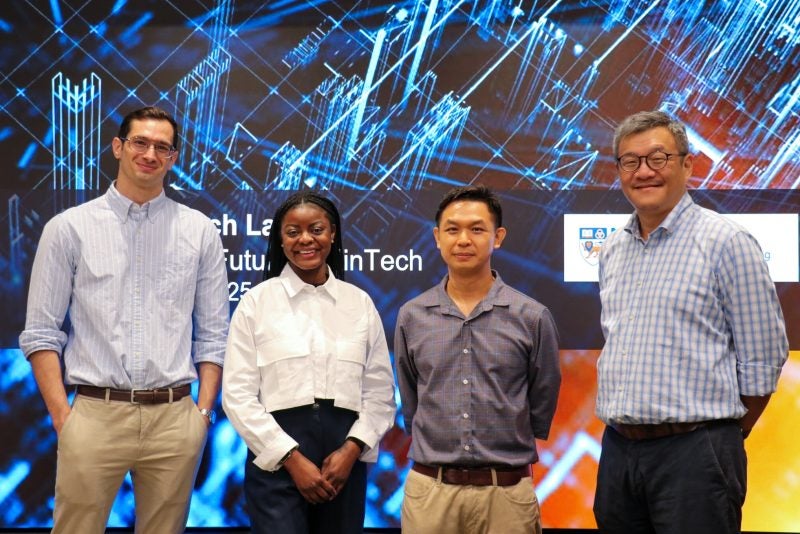

6 November 2019 – NUS Computing and Ripple, a provider of leading enterprise solutions for global payments, today announced the launch of the NUS FinTech Lab, established with the objective to fuel the growth of Singapore’s FinTech sector.

The new lab is led by an industry liaison group made up of representatives from business and financial institutions, government agencies and appointed faculty members of NUS Computing. It will serve as a locus of cooperation and a facilitator of conversations between industry players, government agencies, regulatory bodies and educational institutions. The lab will bring together a diversity of expertise that could be deployed to work on promising FinTech projects, as well as provide resources to train the next generation of business leaders, entrepreneurs, computer scientists and professionals to develop and apply emerging technologies in the area of FinTech.

The NUS FinTech lab is the cornerstone of a broader strategic partnership between NUS and Ripple’s University Blockchain Research Initiative (UBRI), an academic partnership programme with top universities around the world to support academic research, technical development and innovation in blockchain, cryptocurrency and digital payments. UBRI has facilitated both NUS Computing and Ripple in advancing their work in education, technical development and innovation in digital transformation, data-driven decision making, and FinTech. The lab is the latest development of the partnership to deepen FinTech capabilities in Singapore.

“Singapore is already a recognised FinTech hub as home to some of the most competitive academic institutions in the world,” said Eric van Miltenburg, SVP of Global Operations at Ripple. “The launch of the NUS FinTech Lab is a significant step toward recognising the full potential of blockchain technology in finance and the real-world benefits of collaboration between academia and industry. Perhaps most importantly, the FinTech Lab will prepare students for the career opportunities brought about by continued technological advancements in finance.”

The NUS FinTech lab will also form the education arm of NUS Computing’s Industry FinTech Initiatives (SIFI) launched in 2018, to spur FinTech-related activities such as educational workshops, training seminars and short-term projects. The lab plans to expose 1,000 students and industry professionals to FinTech within a year through various courses and programmes open to all NUS faculty and students, as well as all levels of industry professionals.

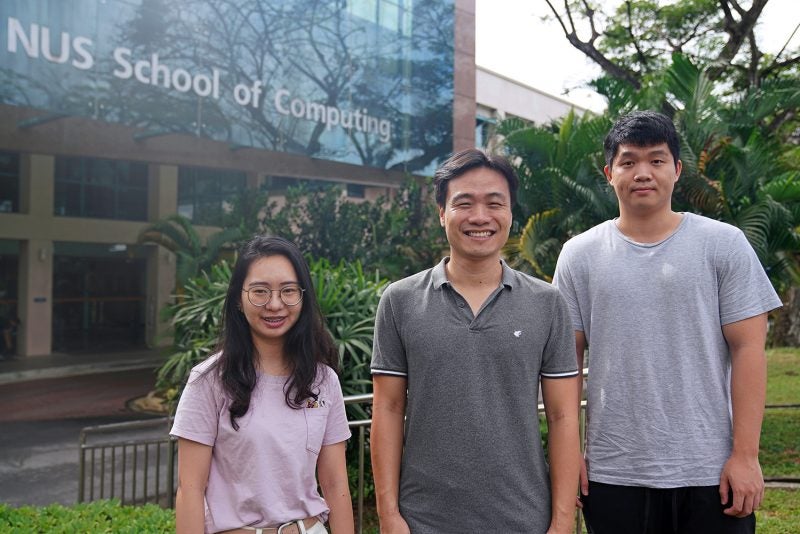

“As we enter a truly digital era, providing the decision-makers of tomorrow with the knowledge necessary for success is paramount. NUS Computing has been a long-time advocate of actionable intelligence through engaging and experimenting with emerging technologies as seen by the recent launch of SIFI followed by the NUS FinTech lab. The lab will provide a neutral space for dialogue and innovation, connecting the worlds of academia and industry so that our education programmes can be readily translated into practice and in turn generate tangible results,” said Professor Mohan Kankanhalli, Dean of NUS Computing and Chairman of the NUS FinTech Lab Advisory Board.

“At present, FinTech is heavily integrated into every facet of our society. However, we still witness hesitation from individuals and businesses when facing FinTech, stemming from the belief that digital transformation is complex. With the new lab, we aim to decipher the complex, and make it easier for everyone to understand FinTech. With our best-in-class programmes, NUS FinTech lab will function as a platform of learning where students can showcase their innovative work, and industry players can learn how to leverage technological advancement to gain competitiveness,” explained NUS Computing Associate Professor (Practice) Keith Carter and Director of the NUS FinTech Lab.

Media mention:

The Straits Times, 7 November 2019

The Business Times, 6 November 2019

NUS News, 6 November 2019